Trying to guess how your portfolio might perform in the future can feel like looking into a crystal ball. But with a Monte Carlo simulation, you don’t have to guess—you can simulate hundreds of possible outcomes based on real historical data.

Welcome to the Monte Carlo Simulation Tool

This tool helps you visualize how your portfolio might behave over the next year by running simulations rooted in historical market behavior. Whether you're testing a new strategy or stress-testing your current allocation, it's a smart way to get a clearer picture of future possibilities.

Step 1: Choose Your Historical Window

Start by selecting the time period you want to base the simulation on. The tool uses this range to understand past market behavior and generate potential future outcomes.

Step 2: Decide How Many Simulations to Run

You can choose anywhere from 1 to 1000 simulations. Running more simulations gives you a fuller, more detailed picture of the range of possibilities—from best-case scenarios to worst-case drawdowns.

Step 3: Add Your Stocks and Set Their Weights

Type in each ticker and click “Add Ticker.” After each one is added, you’ll be able to assign a weight (in percentage) to that stock. These weights represent how much of your total portfolio is invested in each stock. Make sure the total equals 100%—that’s essential for the simulation to run properly.

Step 4: Run the Simulation

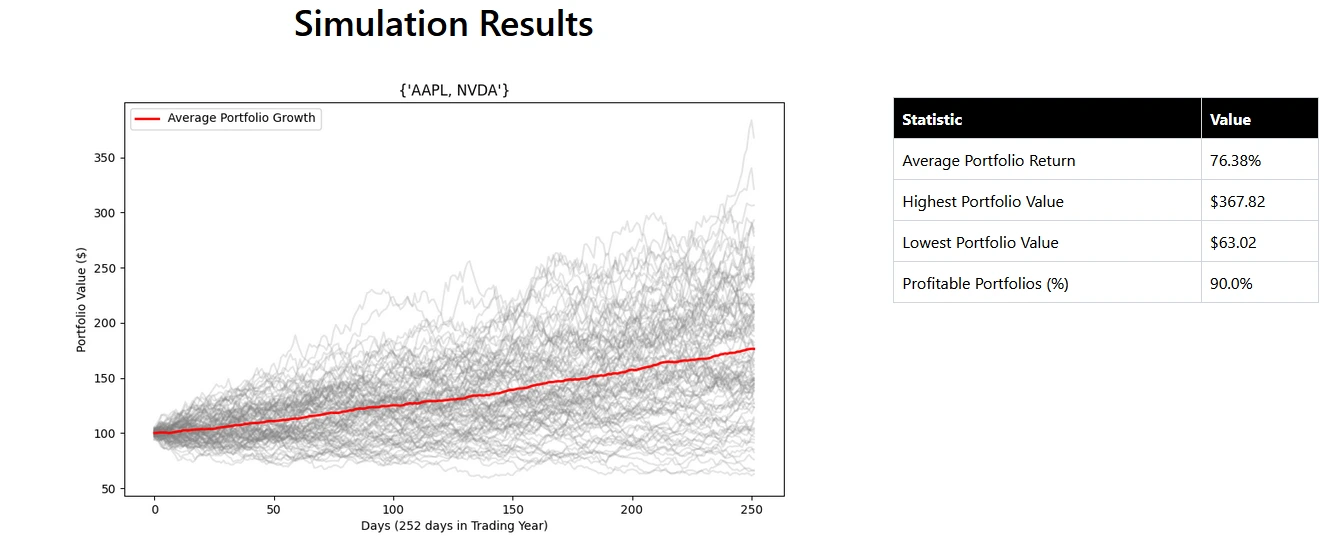

Once everything’s set, hit “Run Simulation.” You’ll see a chart populate with hundreds of lines—each one showing a different path your portfolio might take over the next year.

The red line represents the average outcome across all simulations, giving you a clear baseline. The spread of the lines shows how much variability (or risk) is baked into your current setup.

Step 5: Review the Results

To the left of the chart, you’ll find key insights:

-

Average return

-

Best and worst-case outcomes (based on a $100 investment)

-

Percentage of simulations that ended in profit

This is where the value of the Monte Carlo tool really shines—you’re not just seeing one future, you're seeing many, all rooted in realistic market conditions.

📊 Want to know the range of possible outcomes for your portfolio? Try the Monte Carlo Simulation now and make smarter investment decisions by seeing the full picture—risk, reward, and everything in between.